Stop spreading thin: one channel can beat seven

Welcome to B2B Growth Secrets, where every week, we listen to dozens of B2B Growth podcasts and extract the top actionable ideas. (For more context on these ideas, give the podcasts a listen)

In this issue:

Editor’s corner – Kill the t work for high-ticket B2B sales

Multi-channel strategies are killing your growth: lessons from Arvow about nailing 1 channel

The fake “menu” button that validated a million-dollar product pivot (before writing a single line of code)

1. Kill the hope: "Even if they deliver 1 deal..." doesn’t work for high-ticket B2B sales

Every week, another B2B agency slides into your inbox with a seductive pitch: "We'll get you 20 qualified leads on your calendar – guaranteed." The mental math seems bulletproof. Even if they deliver just ONE lead that converts into a $100K client, your ROI would be 10X. How could you NOT test this?

This seemingly rational calculation has become the most expensive trap in B2B sales. Here's why the math that sounds so good is actually destroying your business.

The conversion funnel nobody talks about

Let's walk through what actually happens when agencies promise "guaranteed leads." Across all industries, cold email converts at 0.2% – meaning you need to send 464 emails to close ONE deal. But that's just the average. For B2B technology companies selling complex solutions, the numbers get dramatically worse.

For SaaS specifically, the conversion rate drops to just 0.03% requiring 3,249 cold emails to land a single deal. Think about that. An agency promising you 20 qualified leads per month would need to send between 9,280 and 64,980 emails just to deliver on that promise, assuming everything goes perfectly.

My experience? I hired an agency to send 20,000 emails and I got exactly one reply: "How does this work?" No meeting. No sale. Nothing. That's a 0.005% response rate and a 0% conversion rate. My numbers aren't unusual – they're typical for high-value B2B sales.

Why deal size kills cold outreach

The "even if they deliver a fraction" logic only works if that fraction is mathematically possible. For low-ticket products, cold email can work. But as your deal size increases, the probability of success through cold outreach collapses.

Cold calling and direct sales outreach is the lowest-performing acquisition channel, converting at just 9% from sales calls. Compare that to referrals at 26% or even paid search at 16%. Cold outreach performs worse than every other channel precisely because it lacks the trust and context that high-value deals require.

The agency playbook: promises and fine print

Only 50% of B2B appointments booked through guaranteed lead generation programs actually show up. So when an agency promises 20 meetings, you might actually get 10. And of those 10, based on industry averages, perhaps 1-2 might convert if you're exceptionally lucky and selling a lower-ticket product.

One startup, Code200.io, spent $30,000 over six months with a "guaranteed" lead generation agency. They converted just three potential representatives willing to beta-test their product. The agency delivered on quantity metrics while completely ignoring quality.

The smartest agencies deploy a delay tactic. Contracts often include auto-renewal clauses requiring 90 days' notice to cancel. For a three-month program, you'd need to cancel before seeing any results. They'll tell you "cold outreach takes 3-6 months to work" – conveniently long enough to collect multiple retainer payments before you realize nothing is working.

These agencies don't waste time pitching established companies with robust inbound lead generation. They target desperate founders for whom this agency represents a last resort. As one analysis notes, "well over 70% of them are built on taking other people's courses and not on actual working knowledge of marketing and psychology."

The test that seems to make sense never does

"Let's just test it for a few months" sounds prudent. But at $2,000-10,000 per month, you're spending $6,000-30,000 for that "test." For a $100,000+ deal, you'd statistically need to send tens of thousands of emails to close even one opportunity. The math doesn't work – not because cold email is inherently broken, but because cold email at scale cannot navigate the complexity of enterprise sales.

High-value B2B deals involve 6-13 decision makers, 6-18 month sales cycles, and require trust that takes time to build. An agency you hired last month sending mass emails can't replicate the credibility of a warm introduction, content-driven relationship, or genuine industry presence.

The trap isn't the promise. The trap is the calculation. "Even if they deliver a fraction..." only makes sense when that fraction is actually achievable. For high-ticket B2B sales, it simply isn't.

2. Multi-channel strategies are killing your growth: lessons from Arvow about nailing 1 channel

Breaking B2B with Sam Dunning, Episode: Founder Shares $5M+ SaaS Marketing Strategies (That Actually Work) (Aug 18, 2025)

Arvow hit $5 million ARR. Bootstrapped. Their secret? They ignored every piece of advice about diversifying marketing channels.

95% of their signups and revenue come from YouTube. Not "YouTube is one of our top channels." Not "YouTube drives a lot of our growth." Literally 95%.

When Vasco Monteiro first shared this stat, the natural reaction is: "That's dangerous. What if YouTube changes the algorithm? What if your account gets suspended?"

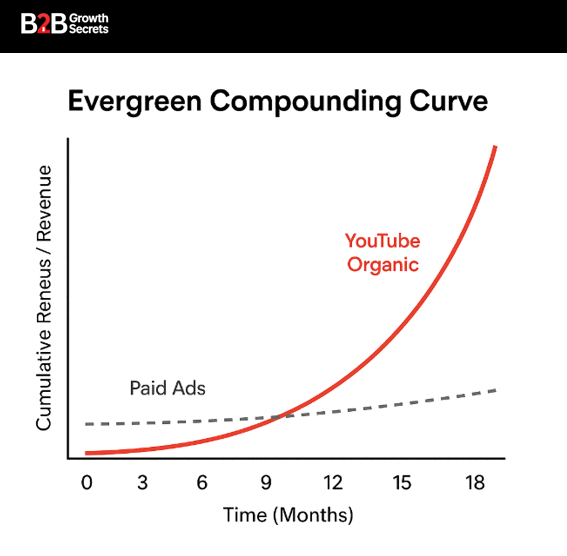

But here's what most B2B marketers miss: When you find a channel that works, the mistake isn't over-indexing – it's under-investing.

Arvow didn't start with YouTube dominance. They tested Reddit (failed), Twitter (worked early, then stopped), Meta ads (burned thousands with no ROI), webinar funnels (complex, unprofitable), retargeting (nope), VSL funnels (nada).

Every channel got a fair shot. YouTube was the only one that consistently delivered.

How they got YouTube to work for them as a channel

For one full year, Arvow published a 10-20 minute YouTube video every single day.

Not shorts. Not repurposed clips. Full videos. Most got 100-200 views. For months. While Vasco kept showing up.

This is where 99% of B2B companies quit. They post for 30-60 days, see mediocre results, and declare "YouTube doesn't work for our niche."

But here's the compounding magic: Those videos from last year still get views today. They're evergreen search traffic machines. Someone searches "how to create a Wikipedia page" and finds a tutorial Vasco made 18 months ago. At the end, after sharing all the steps to create the page, he closes with: "Or just pay this person on our marketplace to do it for you."

The framework is simple:

Show them how to do something manually (give away the entire playbook)

Make it clear it takes time, expertise, and effort

Offer your tool as the “easy” button

As Hormozi says: "Give away everything for free, then sell the implementation."

The 3 video types that drive SaaS revenue

Vasco doesn't randomly post. He uses three specific video formats:

Type 1: Evergreen search-based content

"How to rank on Google" or "How to optimize for ChatGPT search." These target bottom-funnel searches and drive conversions for months or years.

Type 2: Viral/trending content

Posts that capitalize on what's hot right now. Lower conversion intent, but massive reach. These fill the awareness bucket.

Type 3: News-based reactive content

"Google just released a new update" or "GPT launched a new model." First-mover advantage on breaking news in your niche.

Most B2B companies only do Type 1 (if they do YouTube at all). But the right mix is what makes it work.

Why $10K clients are easier than $100 clients

Arvow started at $9/month. Now their cheapest plan is $59/month.

They kept raising prices. Every time most purchases came from the highest tier, they raised it again.

The counterintuitive lesson: Higher prices attract better customers.

Cheap customers expect the world. They flood support. They leave bad reviews when things break. They churn fast.

Expensive customers are tolerant. They understand things break. They appreciate value. They stick around.

Vasco was terrified to raise prices. He thought his YouTube audience – built on accessible, educational content – wouldn't pay premium rates.

He was wrong.

The agencies watching his content? They immediately saw the value. They didn't blink at higher prices. In fact, raising prices filtered out the bad-fit customers who would have destroyed their support bandwidth and team morale.

The pricing insight: If you're selling to solopreneurs, SMBs, and agencies simultaneously, you're trying to build three different products. Pick one. Build for them. And price accordingly.

Why every failed paid ad was actually a win

Arvow burned thousands testing Meta ads. Different funnels. Different offers. VSL funnels. Webinar funnels. Lead magnet sequences.

Nothing worked profitably. Most founders would call this failure. But Vasco sees it differently.

Every failed experiment eliminated a distraction. Now he knows with certainty: organic YouTube is the growth engine. Everything else is noise.

This gave him permission to go all-in. Hire creators. Launch multiple branded YouTube channels. Build a media company inside his SaaS.

When other founders are spreading budget across seven channels hoping something sticks, Arvow is printing money with one channel they've completely mastered.

The 64,000-person email list nobody talks about

Arvow has 64,000 email subscribers. It’s a mix of free users, paid customers, and abandoned signups.

Here's what shocked Vasco: Initially, he thought, "Most of our customers come from YouTube, so why email them about new videos?"

Well, he was proven wrong.

When they started sending new YouTube videos to their email list, they saw direct conversions in Customer.io tracking. People found them once on YouTube but never returned. Yet the email reminder triggered purchases.

The lesson: Discovery and conversion are different moments. Someone may discover you organically but needs multiple touches to convert. Email provides those touches without relying on algorithm luck.

The bottom line: Stop diversifying. Start dominating.

Every marketing playbook says diversify your channels. Spread the risk. Don't put all eggs in one basket.

For early-stage SaaS? That's terrible advice.

Diversification is for companies with proven product-market fit (PMF) and excess resources. If you're bootstrapped or pre-PMF, spreading thin across channels means you'll be mediocre everywhere and excellent nowhere.

Find one channel that works. Master it completely. Dominate it so thoroughly that competitors can't catch you.

Then – maybe – consider a second channel.

3. The fake “menu” button that validated a million-dollar product pivot (before writing a single line of code)

SaaS Club podcast, Episode: Mailtrap: From 20,000 Email Disaster to 7-Figure SaaS (Oct 9, 2025)

The feature request trap every SaaS founder falls into

Mailtrap customers kept asking: "Do you have email campaign functionality? We don't want to buy Mailtrap for testing and transactional emails, then buy Mailchimp for campaigns."

Most SaaS founders facing this either ignore it (too hard) or immediately start building (expensive bet).

Sergiy Korolov did neither.

The $0 Validation Experiment

His team added "Email Campaigns" to the navigation menu. When users clicked it, they landed on a Typeform: "We're planning to build this. Can you help us with insights? What would you want to see?"

No rewards. No discounts. No incentives. Just the word "Soon" and a survey.

300 people responded in a few weeks.

Think about that. 300 users volunteered their time to fill out an unrewarded survey about a feature that didn't exist. That's not polite feature requests from a vocal minority. That's validated demand from people willing to invest effort to help shape it.

What the responses actually unlocked

Those 300 responses told Mailtrap exactly which features to prioritize, which use cases mattered most, how customers currently solved this problem, what integrations were non-negotiable, and pricing expectations.

Compare this to traditional product development: customer requests trickle in sporadically, the product team debates whether it's worth building, someone with the loudest voice wins, six months of engineering follows, then launch to crickets because the five people who asked don't represent real market demand.

Users don't get annoyed (they get invested)

Most founders worry users will be annoyed clicking a button that doesn't work. But the opposite seems to be true.

When you show customers you're considering building something they want AND ask for their input, they feel heard, valued, and invested in the product's direction. Mailtrap didn't get complaints. They got volunteers.

The math that changes everything

Building features is expensive. Validating demand is cheap.

A fake button and a survey cost zero dollars and two hours of implementation time. Building the wrong feature costs six months of engineering, $200K+ in fully-loaded costs, and opportunity cost of not building the right thing.

The brutal question every founder should ask: Which feature request keeps coming up that would require significant engineering investment?

Before you build it, add a fake button, link to a survey, wait two weeks, and measure response quality. If you get 100+ detailed responses like Mailtrap? Build it. You just de-risked a major product investment with a 2-hour experiment.

If you get five responses? You just saved yourself six months building something nobody wanted.

Disclaimer

B2B Growth Secrets extracts key insights from publicly available podcasts for educational and informational purposes only. It is not legal, financial, or investment advice; please consult qualified professionals before acting. We attribute brands and podcast titles only to identify the source; such nominative use is consistent with trademark fair-use principles. Limited quotations and references are used for commentary and news reporting under US fair-use doctrine.